About The US Economy Today

Below is a case concerning recession and inflation based upon the forces created by the most influential players in the US economy, government, and the Fed. Broadly speaking the forces applied by government are inflationary and those applied by the Fed are deflationary. Seems like sort of a tug of war that should have a “winner.” If the Fed wins, we will have a recession. If government wins, we will have inflation.

A little background

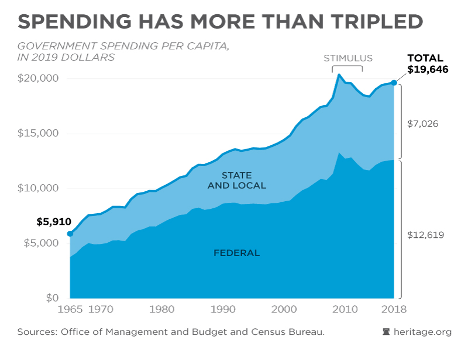

All levels of government in the US have been increasing per capita spending at a rate exceeding 25% per annum (see the second table below). This average annual growth rate goes back to 1965. The graph reflects:

- Spending on a per capita basis – which is the most important way to think about government spending because most spending increases are for social programs.

- The slope of the graph shows that annual average growth rate of 25.8% per year. This is more than 10 times the rate of expansion of US gross domestic product.

- Growth has been fairly constant over time independent of what party was in control of government.

- The bureaucratic institutions in place at all levels of government march to the tune of increased growth and politicians who tend to come and go do not have the staying power to change that equation, even if they wanted to.

For two key reasons the Fed will not stop raising interest rates until the target inflation rate is approaching 2%.

- The Fed believes that inflation hurts everyone while recessions do not. Jay Powell has said repeatedly that he knows recession is a likely outcome of his interest rate policy, but that is the necessary consequence of getting inflation down.

- Jay Powell will not set himself up to be criticized for having taken his foot off the interest rate accelerator too soon and consequently reigniting inflation.

Even in the face of fairly rapidly rising interest rates, forces of inflation have proven to be difficult to overcome. For over a year pundits reflected that inflation was caused primarily by supply chain problems. Though that may be true, those issues are by and large behind us now, but inflation continues at a high rate relative to the Fed’s target rate.

The money supply could end up being the key contributor to a serious recession. Economists supporting this notion point out that direct government intervention and quantitative easing added $9 trillion to the money supply in 2020 and 2021. Quantitative tightening and rising interest rates are dramatically shrinking the money supply which could yield a significant reduction in GDP.

Modern monetary theory is completely wrong. Believers of MMT will say that in the long run inflation caused by printing money subsides and the important thing is for the government to provide services like universal healthcare. Thankfully the politicians who are very willing to sign up for MMT are not in a position to increase the money supply to fund their wish list.

The key inflationary and deflationary pressures (considerable impact and less impactful) currently effecting the economy are listed below:

GOVERNMENT

- Employment Rate and workforce participation (Inflationary)

- Food stamps, child tax credit, long term disability and other transfer programs are keeping workers out of low wage jobs.

- Inflation caused by need to raise wages to attract workers

- Environmental (global warming) (Inflationary)

*This is going to get HUGE within the next few years.- Increased energy costs

- Increased spending on mitigation

- Increased spending on alternative energy sources

- Increased cost of supporting climate refugees

- Increases cost to clean up disasters

- Regulation (Inflationary)

- Higher costs (see CA, NY and other blue states)

- Reshoring is hampered

- Higher taxes—Governments can finance spending by raising taxes or increasing debt. Both have been happening. (Deflationary)

- Lower spending power for consumers

- Lower investment by corporations

- More movement of jobs to low-cost countries

- Lower stock prices caused by less money for buybacks and stock purchases

- Higher borrowing costs

THE FED

- Higher Interest Rates (Deflationary)

- Lower core inflation

- Reduced capital goods purchases by consumers (cars, houses and other high cost items)

- Reduced investment and operating costs for companies

- Reduced employment

- Fed quantitative tightening (Deflationary)

- Reduced money supply

- Reduced investment and OpX by companies

- Bankruptcy of companies unable to borrow to stay solvent

- Stock Market (Deflationary)

- Reduced market value

- Wealth decrease for shareholders reducing their spending

Strong Dollar (Deflationary)

- Lower inflation for imported goods

- Decreased exports

Immigration (Deflationary and Inflationary)

- Reduced job cost inflation

- Increased transfer program costs

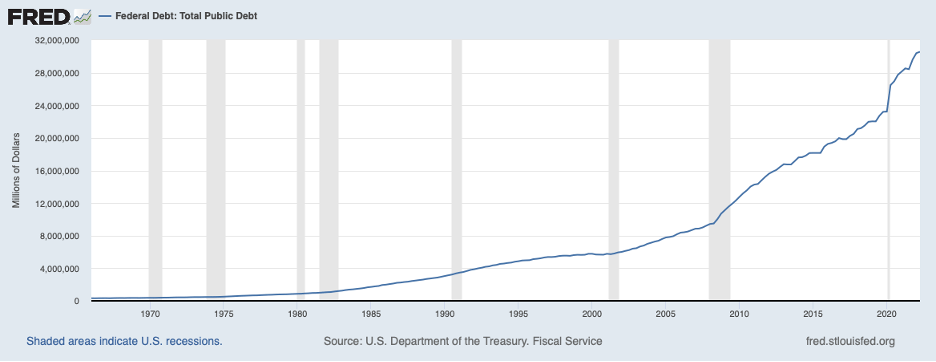

The table below graphs the combined level of debt for US federal, state and local governments, which exceeds the US GDP.

Final thoughts

A soft landing has been the result of over half of the Fed’s last 11 attempts to cool inflation. A notable exception is Paul Volcker’s late 1970s hard landing, which he pretty much engineered. An interesting comparison to our current attempt was in the mid 1960s when Lyndon Johnson was attempting to fund both large social programs and the Vietnam War. The Fed’s sharp interest rate increases up to 9.2% were not enough to push inflation down. Johnson tried to help the Fed by engineering a tax hike that took effect in June of 1968. By mid 1968 aggressive demand and inflation were operating with a full head of steam. A mild recession occurred in late 1969, but inflation did fall to about 5% in 1971.

***

As I am at heart a monetarist, meaning that growth in the money supply creates, at least in the short run, inflation. My money is on the Fed to win out. What do you think will happen? Send me a message at john@grillos.net.