How To Determine The Right Exit Path For Your Business

There are several ways to accomplish an exit from your business but the three most common are sale, IPO or merger. This paper helps you decide on which path or paths are most likely to be open to you at the time of a desired exit.

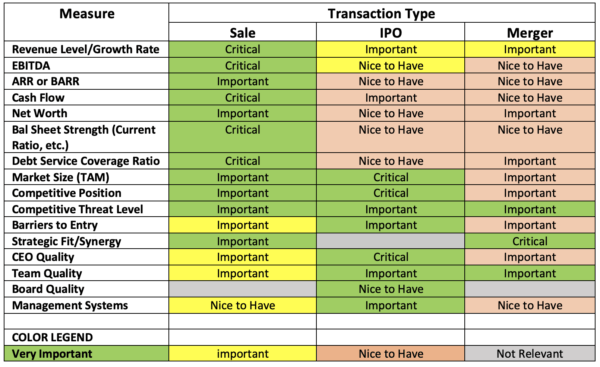

There are 16 variables (Measures) that determine the value of your company, and the importance of each measure varies depending on the exit path. The table below presents the measures and qualifies each according to its importance in each of the three exit paths.

The colors of each box are a way to add a dimension of relative importance to the entry in the box as many boxes have the same text entry. For example, the value in a green box is more important than the same value in a yellow box. The text in each box sorts measurements according to how important they are to the transaction type.

Here is some texture for the values of the measures:

- Critical—means that below a measurable and high threshold value the exit path may not be available to you or your exit value will be low.

- Important—means that the measure is of high interest to the exit path.

- Nice to Have—means that the measure is of interest but there is likely no value that disqualifies the exit path.

- Not Relevant—does not apply to the path documented in the column.

The Process For Deciding Which Path & Maximizing Company Value

- For each path you want to consider, construct a rank ordered list of measurements. That list would have the following sequence of importance:

- Green/Critical

- Green/Important

- Yellow/Important

- Yellow/Nice to Have

- Beige/Important

- Beige/Nice to Have

- Grey (not relevant)

- Make an assessment of where you are in each measurement and where you want each to be at the time you begin the process of an exit. Set your goals high as you have little chance of meeting a stretch goal if you have not defined what it is.

- Do the analysis needed to determine what improvement is needed for each Measure, the cost of improving the Measure and a schedule for doing so. The goal is to make each Measure meet the intended exit value.

- Create an overall picture of Measure improvements needed to get to the exit aspiration. This is done by combining the individual analyses done in Step 3 into a unified analysis which gives you a picture of what must be done, what is will cost and how long it will take. The unified picture must guide you in deciding if you have the financial resources and time needed to get to the exit aspiration. If you determine that you need outside capital to finance the changes, you need to evaluate your options for getting it. If a disconnect between needed and available financial resources is not resolvable then a partial redo of steps 1-4 needs to be done to bring financial capacity and needs into alignment. Break them down into the following order for adjusting the Measurements to get them to conform to a financial constraint:

- High Value and Easy

- High Value and Hard

- Low Value and Easy

- Low Value and Hard

Once you have a balanced view of the Measures you want to take the hard work starts, which is preparing and executing specific project plans the get the desired results. A great resource that will help is IntelliVen’s Toolbox which has many forms for structuring your detailed plans.

Deciding the right exit path has many factors. Book a free consultation today to learn more about working with an experienced exit planning strategist to optimize success.